Intervista Francesco Nalini

"An unlisted company could in the long-term «rest on its laurels», settling and no longer possessing that desire to grow and to always perform better."

When did the idea of becoming a Borsa stock exchange listed company first come to be? What were the reasons that pushed the company to be listed?

The public listing represents a long-term project we had for years, and the main reasons were associated with the conviction that a listed company, even if family-run, on average in the long-run performs better compared to a similar company that is unlisted. This is actually shown by many studies. A completely private-owned unlisted company, especially if successful, could in the long-term "rest on its laurels", settling and no longer possessing that will, that desire to grow and to always perform better than rather, on the other hand, when a company is listed, inevitably, it must have. This was the main consideration in our assessment regarding public listing. Then, there are other implications, some we imagined even before and others that we discovered later like the fact that, as a public listed company, CAREL had nonetheless more visibility and ease in attracting new talent. Lastly, being listed can help in accessing capital, useful, for example, for a large acquisition or a big investment, such as currently, when we are thinking about capital increases to finance growth.

With what criteria was the date of the listing established?

The year of the listing was not decided in advance. Simply, at a certain point, we realised that we were sufficiently big and ready and that it made sense to do so at that time.

Furthermore, the exact date depends on the process, because getting listed takes time. It is a complex process that includes many steps, also involving authorisations and compliance. Not only are Consob and Borsa Italiana authorisations required, but introducing yourself to investors is also necessary, therefore, several months of work was needed.

What was the approach path to the financial markets to get closer to the listing?

What was the approach path to the financial markets to get closer to the listing?

During the IPO (the Initial Public Offering to be admitted to the public listing) we started an education programme for the investors, who at the time knew nothing about us: for approximately nine months we met with them several times in the financial centres of Milan, Paris, London, Frankfurt, New York.

We dedicated a great deal of energy to establishing a dialogue with them and with the market in general, and this was always met with good interest. It is an aspect to which we have dedicated much attention since the beginning and which we continue to take care of, even if it requires much time (especially mine in particular). But it is absolutely worth it. There are medium-sized companies, similar to ours, that decide to become listed underestimating the importance of dialogue with investors, something which is instead decisive: having tens of thousands of companies on which they can invest, the investors prefer doing so with businesses that are transparent, speaking with them, meeting with them, and whose management they know. In other companies, this sensibility is growing, and I believe that we were an example from this point of view.

In our approach path, we had to draft the project, or a detailed and precise description of the company, with verifiable information and data. Impressions or general information cannot be reported: the data must be demonstrable, and this, therefore, requires a great deal of work. Drawing up a business plan was also required for Borsa Italiana. This, too, with tangible and verifiable data. At the actual time of the listing (in the previous days), the most important and final meetings with the investors took place, in which we basically "took the orders".

Everything unfortunately took place in a not very serene period, a period in which financial markets were fearful because of a change in government in Italy: it was a really complicated time. We organised a final funding road show in Milan, but it was not a success. In London, on the other hand, things went better. There, ironically, there was less worry for the Italian political situation; after London, the situation improved. This is also one of the reasons for which approximately 90% of our investors is international: still today, we have few Italian investors. Finally, the day of the listing went well, with a demand that exceed the offer four times over.

"...investors prefer businesses that are transparent,

speaking with them, meeting with them,

and whose management they know."

How did the relationship with the investors evolve, starting from the listing and in the period following? What are road shows? What are they used for and how often do you participate in them?

As I was saying, dialogue with the investors is essential, in fact, right from the beginning we created the role of the Investor Relations Manager, something not very common in other newly listed companies of our size. Frequently, we organise visits here in the headquarters for the investors, because it is very important for them to physically see the company. Considering the market in which we live and the products that we produce (or internal components that are not visible), explaining what we do is not easy.

For this reason, it is important to realistically show our company: in a two-hour visit it is not possible to understand too many things, but it is possible, to some extent, to breathe the company’s culture, see how it works and the fact that we are led by good managers. In addition to these visits, we also participate in periodic meetings with the investors, going to visit them in their offices.

Another contact method is the conference, where companies and many investors meet. It is a type of trade fair, where the different organisations meet. This method gives you the advantage of meeting many investors in just a single day, in Milan, in London and in other cities: at these events, generally, we meet people who already know us, people who may have or may not have already invested in CAREL. Therefore, the latest developments in the business strategy, considerations on the trends on the market and in the company are illustrated. It is essentially an update.

There are also the so-called discovery meetings, with investors who still do not know about the company, and where it is necessary to explain everything about CAREL in detail.

The two main seasons for the road shows are the spring, following the full year results (the results for the previous year) and the fall, after the results of the current year’s first semester. During these periods, for several weeks we are involved in conferences or meetings with investors. After the break due to the pandemic, the investors had a great desire to get back to meeting in person: this is much appreciated because a personal relationship is also created between the investor and management. Trust is essential, and meeting in person is key. Many CEOs do not really like this phase, considering it to be boring and time-consuming. Personally, even if demanding, I have always considered it very useful because when continuously discussing strategy, you are led to always reflect: this must be very clear and rationalised in the mind of the person who will do the explaining. Discussing and responding to the questions that are asked, it evolves continuously. There is, therefore, a great advantage in constantly reasoning on strategy, an advantage you do not have when you are unlisted, at least in my experience. The repeated questions of the investors make you think, and as a result implement the reasoning. For example, a common question is: "Why are you not very present in the United States?" This leads us to think and at times receive tips also on how to grow more quickly. Or perhaps risks are highlighted. And by listening, we are led to think and to find countermeasures. All this is extremely stimulating.

The two main seasons for the road shows are the spring, following the full year results (the results for the previous year) and the fall, after the results of the current year’s first semester. During these periods, for several weeks we are involved in conferences or meetings with investors. After the break due to the pandemic, the investors had a great desire to get back to meeting in person: this is much appreciated because a personal relationship is also created between the investor and management. Trust is essential, and meeting in person is key. Many CEOs do not really like this phase, considering it to be boring and time-consuming. Personally, even if demanding, I have always considered it very useful because when continuously discussing strategy, you are led to always reflect: this must be very clear and rationalised in the mind of the person who will do the explaining. Discussing and responding to the questions that are asked, it evolves continuously. There is, therefore, a great advantage in constantly reasoning on strategy, an advantage you do not have when you are unlisted, at least in my experience. The repeated questions of the investors make you think, and as a result implement the reasoning. For example, a common question is: "Why are you not very present in the United States?" This leads us to think and at times receive tips also on how to grow more quickly. Or perhaps risks are highlighted. And by listening, we are led to think and to find countermeasures. All this is extremely stimulating.

Another type of question we are asked is: "Why doesn’t your profitability increase?" And each time we respond that our goal is not that of increasing profitability, something we could easily do by cutting investments. Our goal is that of growing quickly and therefore, if we have more resources, we invest them to grow, not to increase profitability.

Another type of question we are asked is: "Why doesn’t your profitability increase?" And each time we respond that our goal is not that of increasing profitability, something we could easily do by cutting investments. Our goal is that of growing quickly and therefore, if we have more resources, we invest them to grow, not to increase profitability.

Often there is the misconception that investors think only in the short-term. But this is not so: they know we invest in the long-term and they very much appreciate that profit is not maximised in the short-term. So much so that one thing we have been asked about lately is why our R&D spending is down percentage-wise compared to turnover. This is due essentially to two reasons: the first is that sales turnover has grown much more quickly, and we have been unable to grow the investment in R&D just as quickly, but we intend to. The second and biggest challenge in finding people, is finding the technical personnel.

"When continuously discussing strategy with investors

you are led to rationalise it and evolve it,

with a great advantage."

In terms of governance, what has the public listing involved?

We had to include independent directors to the board and we created two committees: the Risk Control Committee and the Remuneration Committee, made up of independent directors. Then, there is the Board of Statutory Auditors, which, in a publicly listed company, has a very important role compared to a private company. We created the Internal Audit department, which did not exist before. There are further aspects of compliance (conformity) that are rather costly, and there is obviously also a bureaucratic burden, which brings costs and additional work. This is undeniable. But, looking at the positive side, being a group that is always more international, with many companies around the world, having an appropriate supervision of the risks is fundamental. Lastly, having independent advisers on the board leads you to have a more rational and structured decision making process.

We had to include independent directors to the board and we created two committees: the Risk Control Committee and the Remuneration Committee, made up of independent directors. Then, there is the Board of Statutory Auditors, which, in a publicly listed company, has a very important role compared to a private company. We created the Internal Audit department, which did not exist before. There are further aspects of compliance (conformity) that are rather costly, and there is obviously also a bureaucratic burden, which brings costs and additional work. This is undeniable. But, looking at the positive side, being a group that is always more international, with many companies around the world, having an appropriate supervision of the risks is fundamental. Lastly, having independent advisers on the board leads you to have a more rational and structured decision making process.

And what has this entailed in terms of growth?

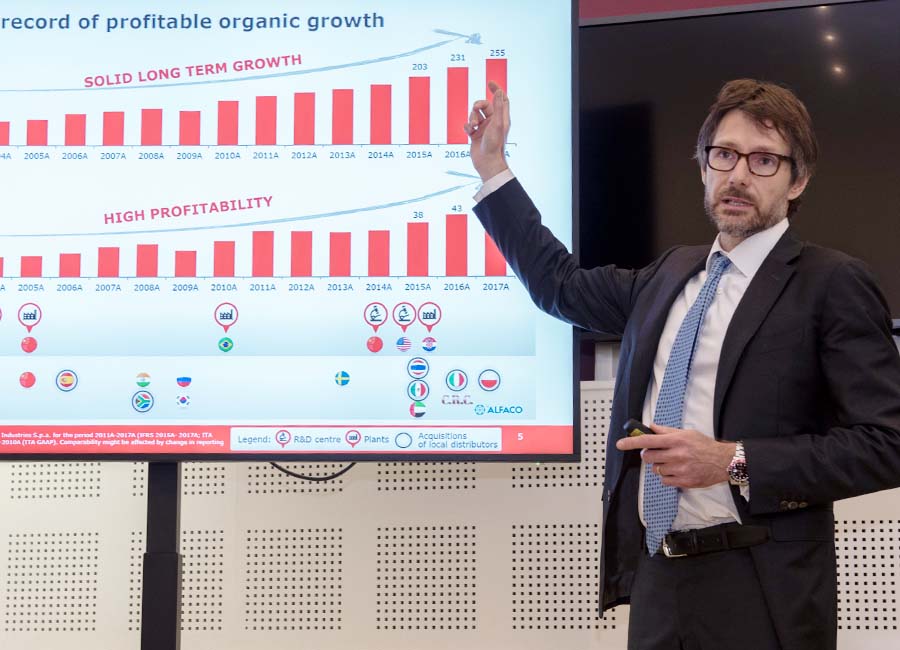

Following the public listing, CAREL’s growth accelerated. Today, our sales are more than double compared to 2018. The biggest change was generated by the launch of an M&A (Mergers and Acquisitions, i.e. takeovers or mergers aimed at changing the structure of two or more companies) strategy that was already in place, but was more tied to the acquisition of distributors. Over the years, CAREL has always worked by acquiring the direct sales network: when a good relationship and a good presence on the market was established, the distributor was acquired, as was the case, for example, in South Africa, Spain, Thailand, Australia, Mexico. Many current branches were initially distributors. We are continuing to do this, it is a strategy that continues, for example, as with New Zealand this year. However, in addition, we started to also acquire production companies that can offer complementary technologies, such as Recuperator and Klingenburg. Or, in the case of HygroMatik, we acquired a competitor, to increase our share of the market in German-speaking countries. We would likely have pursued an M&A strategy even without being listed. The two things did though coincide and I would say this was a success: so far we have completed 11 acquisitions since 2018.

And what about sustainability?

Sustainability has always been at the centre of what we do. The focus of our technology is to save energy in a sector such as that of air conditioning and refrigeration that is responsible for over 20% of all the electricity consumed globally. Today, though, companies are required to have an always more structured approach toward sustainability, presented in its three environmental, social and governance dimensions, with transparent and measurable goals and with great attention to the external communications of these goals and the results obtained. The public listing was essential to help us toward this path of organisation and transparency. Most of our investors is international and many are from Northern Europe: in particular, the Northern European and French funds are extremely sensitive to the issue of sustainability, and from the beginning they have pushed us to set always more ambitious goals. Furthermore, since we have become publicly listed, we have also started to receive a sustainability rating, as with MSCI, the rating most used by financial investors: this has represented an ulterior powerful incentive.

"The focus of our technology is to save energy in a sector such as that of air conditioning and refrigeration that is responsible for over 20% of all the electricity consumed globally."

What are the new limitations and responsibilities resulting from the public listing on the stock exchange?

From my point of view, as I have explained, the key change was that of starting to dedicate a great deal of time to the dialogue with the investors. There are then legal restrictions in terms of confidentiality, in the sense that only data that are public can be communicated... It is not possible to say, for example, "I expect to earn x" unless this information has been made public to everyone in the methods provided for in market practice. Lastly, there is much more responsibility, because now we also have many other big and small shareholders!

What do you expect the public listing to bring (if it will bring something more) in the coming years?

I expect that the public listing will continue to enrich the aspect we have spoken about so far. That is the positive stimuli on the company’s performance and on the focus on sustainability, over the long-term. This will also lead to a growth of our culture, since the limitations and controls that derive from it, in addition to the fact that it is an always more organised and international company, result in a necessary evolution of the managerial culture. In any case, it will continue to have positive consequences.